In Brief

- The NSW Treasurer’s first Budget places fiscal repair and housing at the centre of the NSW Government’s agenda, with a much-needed $3.1 billion housing and planning investment package to address the state’s housing crisis.

- The package delivers key reform recommendations from the Property Council of Australia’s recent Housing Outcomes report, including a Faster Planning Program to leverage government-owned land for housing, additional funding for social and affordable housing and investigating how Artificial Intelligence can be used to make the planning system more efficient.

- Infrastructure funding was higher than anticipated, with an increase in investment of $116.5 billion over the next four years out to FY2026-27, and key projects like Metro West proceeding.

In-depth

1. NSW Executive Director’s View

Earlier today, Daniel Mookhey handed down his first Budget as NSW Treasurer, laying out the economic and fiscal plans for the state.

The 2023-24 NSW Budget delivered on the Treasurer’s commitment to rein in fiscal expenditure and begin the task of Budget repair, with a projected return to operating surplus in FY2024-25. The Budget also contains several initiatives aimed at ending subsidies, reducing government duplication and expanding existing revenue sources.

I was pleased to be able to discuss the Budget with Minister for Planning Paul Scully directly earlier this afternoon and congratulate him on the NSW Government’s well targeted $3.1 billion housing and planning investment package to address the state’s housing crisis.

The package is made up of several initiatives, some of which were previously announced ahead of the Budget, including the $2.2 billion Housing and Infrastructure Plan, $610 million Commonwealth Social Housing Accelerator, $224 million Essential Housing Package, $38.7 million Faster Planning Program, and $60 million for new build-to-rent trials in the South Coast and Northern Rivers.

Increased funding for social and affordable housing and investigating the use of Artificial Intelligence to make the planning system more efficient were key reform asks from our recent Housing Outcomes report, so we particularly welcome their inclusion as part of the Government’s first Budget.

In further welcome news for the sector, the NSW Government has stayed the course on its infrastructure program, investing $116.5 billion over the next four years out to FY2026-27, though the NSW Government has indicated the forthcoming Metro Review will shape future government decision making on the infrastructure pipeline.

However, in a highly cost-sensitive environment, it was disappointing to see the introduction of new taxes on the property sector at a time when they will be doing the heavy lifting to realise the NSW Government’s housing agenda. The changes to landholder duty to reduce the threshold for the acquisition of ‘significant interest’ in a private unit trust from 50 per cent to 20 per cent will unnecessarily discourage property investment.

There is an enormous difference between land that is simply rezoned and land that is ‘development ready’ – the missing ingredient is enabling infrastructure such as water, roads and transport, so it was good to see $2.2 billion allocated specifically for infrastructure to enable the new housing to be delivered.

A comprehensive analysis of 2023-24 NSW Budget commitments, including an overview of the economic and fiscal outlook, major taxation, housing and infrastructure announcements is set out below.

Our media releases are available on our website:

NSW Budget is a housing winner – but more needed for Western Sydney jobs and infrastructure

The pressures of housing stress are the winners of the first Budget of the Minns Government announced today.

NSW Budget delivers a mix of wins and losses for the Hunter and Central Coast

The Property Council welcomed the first Budget of the Minns Government announced today, which has addressed some of the growing pains in the Hunter and Central Coast communities, through investment in a number of health, education, transport and environmental initiatives.

Illawarra Shoalhaven a clear stand out in NSW State Budget

The Illawarra Shoalhaven has been a standout winner in one of the fiscally constrained state budgets ever released since the NSW government was formed in 1856.

Property Council welcomes Minns Government’s first Budget putting housing front and centre

Katie Stevenson welcomed the NSW Government’s well targeted $3.1 billion housing and planning investment package.

2. Economic and Fiscal Overview

Over the 2023-24 forecast period, the state’s economic growth is expected to remain subdued as high inflation and interest rates constrain household expenditure as well as business investment.

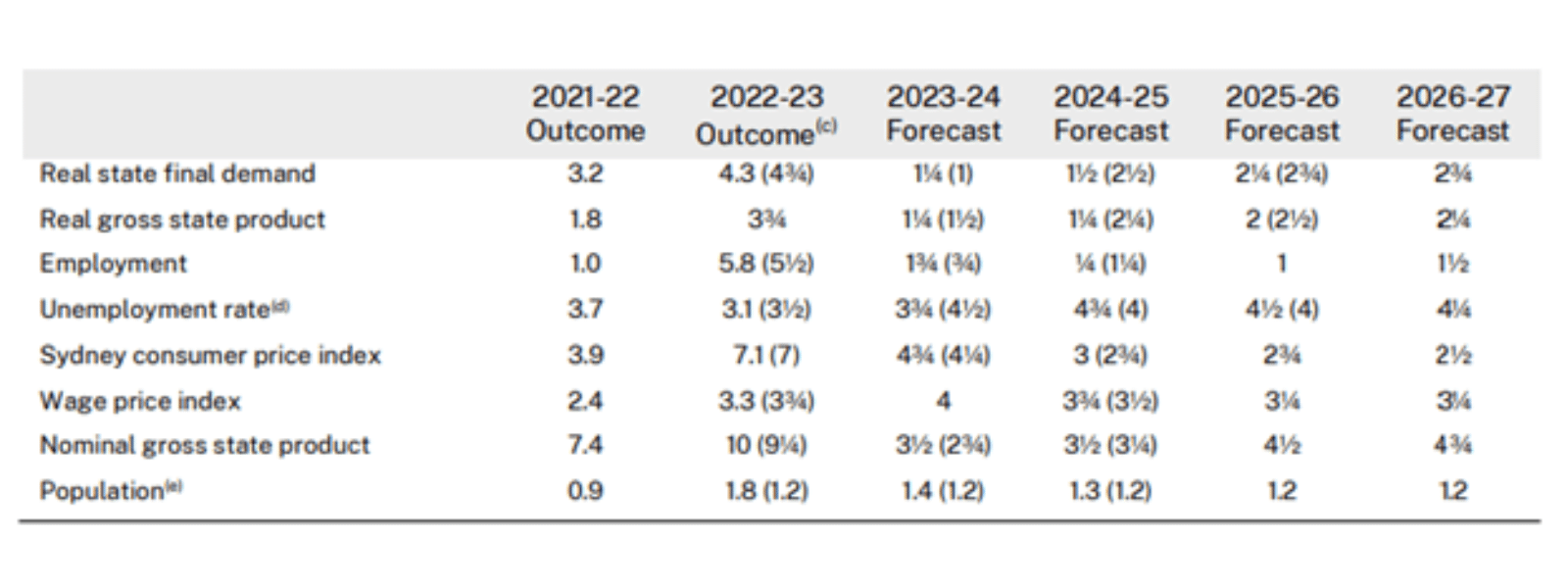

The NSW economy is expected to grow by 1.25 per cent in FY2023-24, while unemployment is forecast to remain low at 3.75 per cent in the same financial year. Economic growth is projected to increase gradually over the forward estimates, reaching 2.25 per cent in FY2026-27 as inflationary pressures ease (see Figure 1). According to the Budget, net overseas migration will contribute close to 500,000 people to the State’s total expected population growth of 580,000 in the four years to FY2026-27, which is expected to underwrite the state’s growth over the period.

Figure 1: Economic performance and outlook

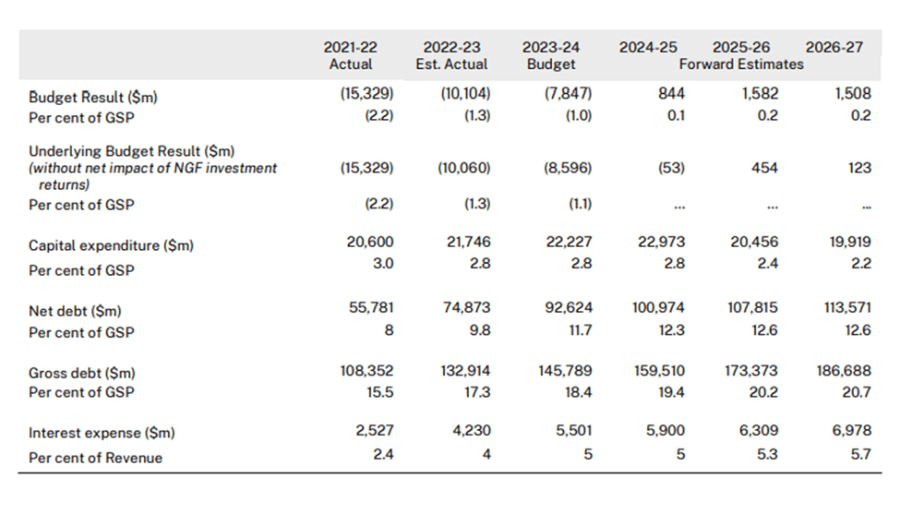

The NSW Budget delivers an improvement in the fiscal position of the state from the 2023 Pre-election Budget Update. The 2023-24 Budget now projects a deficit of $7.8 billion in 2023-24, before returning to an improved surplus of $844 million in FY2024-25.

State revenue is forecast to increase by $14.0 billion over the four years to FY2026-27, supported by stronger transfer duty, land tax, coal royalty and payroll receipts. The state’s gross debt is also projected to improve over the forecast period reaching $173.4 billion by June 2026, which is $14.8 billion below the 2023 Pre-election Budget Update. Net debt is now projected to peak at 12.6 per cent of GSP by June 2027, around 1.4 per cent lower than at the 2023 Pre-election Budget Update.

The decision to begin the transition of TAHE to its new operating model this year delivers on the NSW Government’s election commitment to reform TAHE and eliminate intra-government transactions that were a feature of the previous operating model. The shift to the new model will cost $384 million over four years, but the NSW Government expects interest savings on the debt avoided to offset this expense.

Figure 2: NSW Fiscal Outlook

3. Housing and Cities

The 2023-24 NSW Budget includes a welcome $3.1 billion housing and planning investment package to confront the housing crisis in the state. The package is made up of several initiatives, some of which were previously announced ahead of the Budget, including the $2.2 billion Housing and Infrastructure Plan, $224 million Essential Housing Package, $38.7 million Faster Planning Program, and $60 million for new build to-rent trials in the South Coast and Northern Rivers.

In addition, the NSW Government has outlined a plan to permanently expand social housing dwellings by around 1,500 homes over the next five years through the $610 million Commonwealth Social Housing Accelerator. This investment will be delivered in partnership with Community Housing Providers.

Separate to the housing and infrastructure investment package, the NSW Government has announced it will invest $26.8 million in FY2023-24 to resource the office of the 24-Hour Economy Commissioner, including its expansion to Wollongong, the Central Coast and Newcastle.

Housing and Infrastructure Plan

The Budget includes $2.2 billion for the Housing and Infrastructure Plan. The bulk of the funding allocated under the Plan is generated from the newly created Housing and Productivity Contribution, which will operate as a regional infrastructure charge and apply in the Greater Sydney, Illawarra-Shoalhaven, Lower Hunter and Central Coast regions. The Plan includes:

- $1.5 billion for housing related infrastructure through the new Housing and Productivity Contribution

- $400 million reserved in Restart NSW for the new Housing Infrastructure Fund

- $300 million in reinvested dividends to enable Landcom to deliver an additional 1,409 affordable homes and 3,288 market homes to FY2039-40 on government-owned land.

Whilst the Property Council welcomes the $300 million investment in Landcom, its disappointing the funding with not be focused over the next four years to support delivery of the state’s National Housing Accord targets.

Essential Homes Package

As previously announced, the Budget outlines a $224 million Essential Homes Package including:

- $70 million in interest-free debt financing for the NSW Land and Housing Corporation (LAHC) to accelerate the delivery of social, affordable, and private homes primarily in regional NSW

- $35.3 million to continue to provide housing services for Aboriginal and Torres Strait Islander families through the Services Our Way program

- $35 million allocated to LAHC to support maintenance of social housing

- $20 million reserved in Restart NSW for dedicated mental health housing

- $15 million to establish a NSW Housing Fund, separate to the new Housing and Infrastructure Fund, for priority housing and homelessness measures

- $11.3 million to extend the Together Home program

- $11 million injection to Temporary Accommodation in FY2023-24

- $10.5 million for the Community Housing Leasing Program

- $10 million for LAHC to pilot delivery of modular social homes and investigate off-site manufacturing

- $5.9 million for specialist homelessness services.

Faster Planning Program

The NSW Budget outlines $38.7 million for the newly established Faster Planning Program, which covers a range of budget measures, including:

- $24 million to establish a NSW Building Commission (see further detail in the Building Reform section)

- $9.1 million to assess housing supply opportunities across government-owned sites, including delivery of new social housing

- $5.6 million for an Artificial Intelligence pilot to deliver planning system efficiency.

Following our recent engagement with the Minister for Planning and Public Spaces, the Property Council is pleased to see a focus on greater technology innovation across the planning system with the $5.6 million pilot.

4. Machinery of Government

The NSW Government has taken a staged approach to machinery of government changes to align portfolio structures and responsibilities with priorities for their first term, informed by an ongoing public sector review.

The 2023-24 Budget and Appropriations Bill reflects current administrative arrangements, and additional machinery of government changes due to take effect from 1 January, will be reflected in full in the 2024-25 Budget.

The most prominent of these changes was last month’s announcement that the Department of Planning and Environment will become two new departments from 1 January 2024: the Department of Planning, Housing and Infrastructure, and the Department of Climate Change, Energy, the Environment and Water. The new departments will be joined by the Office of Energy and Climate Change, which is currently in Treasury.

The NSW Government earlier fulfilled an election commitment to improve planning coordination and decision-making by transferring 350 staff from the Greater Cities Commission and Western Parkland City Authority to the Department of Planning and Environment. This is expected to deliver $111 million in savings – a move welcomed by the Property Council as an important step in directing resources to priority areas, in particular housing.

This Budget also sees the NSW Government take its first steps in their promised abolition of the Transport Asset Holding Entity (TAHE). TAHE will be converted into a non-commercial public non-financial corporation similar to Sydney Trains, NSW Trains and Venues NSW, with a revised mandate to maximise the value of its transport assets, especially surplus land near railway stations that could be repurposed to help solve the State’s housing shortage. By the end of the year, The NSW Government aims to transition TAHE to not-for-profit status and introduce legislation to allow for a new operating model to be introduced.

Earlier this month, the NSW Government announced a $115 million funding commitment for the NSW Reconstruction Authority, taking the Authority’s budget to $321.3 million over four years. An early priority of the Authority will be creating a State Disaster Mitigation Plan and Disaster Adaptation Plan.

5. Property Tax

The 2023-24 NSW Budget sets out a series of tax integrity and revenue measures designed to support the Budget repair task and address tax compliance, including across land tax duties and thresholds. Property tax related changes of relevance to the Property Council’s members are outlined below.

First Home Buyers Assistance Scheme

In this Budget, the NSW Government has delivered on its commitment to expand the First Home Buyers Assistance Scheme. Since 1 July 2023, first home buyers who signed contracts to purchase a home have had access to higher stamp duty exemption or concession thresholds under the First Home Buyers Assistance Scheme. First home buyers purchasing a new or existing home can access a full stamp duty exemption for purchases up to $800,000 or receive a stamp duty concession for purchases between $800,000 and $1 million. According to the Budget, the expansion of the Scheme is set to have an estimated cost of $998.2 million over the four years to FY2026-27.

Landholder duty

The 2023-24 Budget outlines changes to the Land Tax Management Act 1956 which currently allows people with at least one per cent stake in a property to claim the principal place of residence land tax exemption. The changes will require individuals who use and occupy land as a principal place of residence together to have a minimum 25 per cent stake in the property to claim the land tax exemption.

The NSW Budget also alters the way the landholder duty is applied to trusts tightened through a reduction in the threshold for the acquisition of ‘significant interest’ in a private unit trust from 50 per cent to 20 per cent. The threshold for acquisition of a ‘significant interest’ in a wholesale unit trust or imminent wholesale unit trust will remain at 50 per cent.

Amendments to the Duties Act 1997 will also reduce the concession received by corporations, from 100 per cent to 90 per cent of the transfer duty otherwise payable when moving assets as part of a restructure.

Land tax thresholds

The NSW Government has also outlined it will revise the operation of the land tax thresholds system, with effect from the 2024 land tax year. An anomaly in the land tax indexation formula and an error in calculations underpinning the 2021 land tax threshold have produced higher than intended land tax thresholds for the last three land tax years. According to the Budget, this has resulted in under-collection of land tax of around $250 million. Amending legislation will revise the indexation formula and ensure the NSW Valuer General can determine the correct land tax threshold for the 2024 land tax year. This correction is estimated to increase land tax revenue by $250.5 million over the four years to FY2026-27.

6. Infrastructure Contributions

The NSW Budget features two new but previously canvassed infrastructure contribution charges. These include the recently introduced Housing and Productivity Contribution, which passed through NSW Parliament earlier this year, and the Development Servicing Plans to be introduced by Sydney Water and Hunter Water.

The Housing and Productivity Contribution is set to raise $1.5 billion, although the period over which these funds will be accumulated is unclear. The NSW Half Yearly Review previously forecast these reforms to increase revenue by $924 million over three years to FY2025-26.

7. Building and Construction Reform

The NSW Government came to power with an established reform platform for the building and construction sector, commencing with the appointment of a dedicated Minister for Building, Minister Anoulack Chanthivong.

Delivering on an earlier election commitment, this Budget establishes a NSW Building Commission, a single body to oversee the regulation, licensing and oversight of the industry, with initial operational funding of $24 million for the Commission to stand up an agency of more than 400 staff.

The Property Council welcomes the creation of a NSW Building Commission as a resourced end-to-end agency to work as a partner with industry to ensure consumer confidence in the building and construction sector, and ensure that the regulatory and compliance regime is supported by industry engagement and education.

The establishment of the Commission will be supported by the introduction of the Building Legislation Amendment Bill 2023 (the Amendment Bill) into NSW Parliament in the coming months. The Amendment Bill will include clarifying the chain of responsibility for accountability for the supply of safe building products and strengthened recall and enforcement powers, greater powers for the NSW building regulator to address intentional phoenixing and insolvency, and proactive regulator powers in the class 1 building space, such as rectification orders, stop work orders and powers of entry during the construction of class 1 buildings to bring it into line with existing powers that apply to class 2 buildings.

8. Public Infrastructure Overview

The 2023-24 NSW Budget has allocated $116.5 billion in capital expenditure to infrastructure over the next four years out to FY2026-27. This represents a $3.8 billion increase in total infrastructure spending compared to last year’s budget. Under the $116.5 billion capital investment program, $85.6 billion is general government expenditure, with state-owned corporations making up $31 billion.

On average, NSW Government will spend $29.1 billion across the four-year budget cycle on infrastructure, which will likely test the ongoing capacity of the civil infrastructure market, with labour and material supply chain pressures remaining a dominant concern for both government and industry.

As expected, the NSW Budget has implemented the advice of the independent Strategic Infrastructure Review, led by Ken Kanofski, and sought to delay or descope projects valued at more than $2.5 billion, including:

- The Greater Western Highway Duplication

- Ultimo Powerhouse Museum

- The Fast Rail Program, and

- Wyangala Dam Wall Raising and the New Dungowan Dam and pipeline augmentation.

The 2023-24 NSW Budget has reallocated this funding to increase investment in new and upgraded schools, hospitals and public transport infrastructure.

Transport Infrastructure

The NSW Budget sets out a strong transport infrastructure investment program, with $72.3 billion allocated over the next four years to FY2026-27. The future of the infrastructure investment program will be further shaped by the findings of the Sydney Metro Review, which will provide recommendations to the NSW Government later this year on how to manage escalating costs.

The NSW Budget largely continues spending on the existing infrastructure projects, including the Sydney Metro program, but also includes some new funding allocations for a series of transport projects and new programs, including:

- An additional $1 billion to deliver Sydney Metro City and Southwest

- $800.7 million for the More Accessible, Safe and Secure Train Stations program combining the Transport Access Program with the Commuter Car Parking Program, which includes an additional $300million committed at the election

- An additional $200 million to progress Parramatta Light Rail Stage 2, which is scheduled for planning determination next year

- $58 million to upgrade Richmond Road between Elara Boulevard and Heritage Road

- $43 million to replace seven Parramatta Rivercat ferries

- $46.4 million as part of the $334 million Regional Roads Fund.

The NSW Government has also committed $770 million (current and recurrent expenses) to establish an Urban Roads Fund over four years to FY2026-27. The funding will be used to plan and build major roads in metropolitan areas, including improvements to key corridors in Heathcote, Riverstone and smaller projects to improve roads in local communities.

Key projects of the Urban Roads Fund include:

- Planning for upgrades on Fifteenth Avenue Smart Transit Corridor

- Duplicating sections of Heathcote Road

- Upgrade Henry Lawson Drive at Milperra

- Upgrading Hill Road at Homebush

- $200 million to upgrade roads in the North West Growth Area as part of the Western Sydney Flood Resilience component of the Urban Roads Fund.

Social Infrastructure

The NSW Budget sets out a combined social infrastructure investment, covering capital expenditure on health and education, of $23.6 billion over the next four years to FY2026-27. The major social infrastructure commitments are outlined below.

Education

The NSW Government is projected to spend $9.8 billion on education capital expenditure in the years leading up to FY2026-27, with $2.8 billion allocated in FY2023-24.

The NSW Budget allocates $1.4 billion in new funding over four years to support the planning and delivery of 34 new and upgraded schools. Projects being delivered include:

- A new primary school near Sydney Olympic Park, with planning to commence for three new primary schools at Huntlee, West Dapto and Calderwood

- New high schools at Medowie, Googong, Jordan Springs, Melrose Park and Gledswood/Gregory Hills

- Upgrades to Northmead Public School, The Ponds High School, Kingswood Public School, Katoomba High School, Jerrabomberra High School and Eagle Vale High School

The Budget papers outline plans to fast-track the delivery of 100 new and upgraded preschools, however no estimated cost or funding allocation has been detailed against the program, despite it being a key election commitment. These schools will be situated in existing primary school locations.

Health

The NSW Budget delivers many of the government’s election commitments to invest in hospitals across the state. The Budget papers include $13.8 billion of health capital expenditure in the years leading up to FY2026-27, with $3.4 billion to be spent in FY2023-24.

Headline items include:

- $700 million for Rouse Hill Hospital – an increase of $300 million

- $350 million toward a $550 million upgrade of Fairfield Hospital

- $328 million toward the Canterbury Hospital Redevelopment

- $190 million for Prince Alfred Hospital

- $128 million for new beds at Blacktown and Mount Druitt Hospitals.

9. Energy and Sustainability

With soaring energy costs and ambitious carbon emissions reduction targets of net zero by 2050, and a 50 per cent reduction on 2005 carbon emissions levels by 2030, energy and sustainability remain prominent on the NSW Government’s agenda.

The NSW Government has now ticked some key items off its election commitments list, including the establishment of the NSW Energy Security Corporation and an Energy Relief Fund. There remains unfinished business with the NSW’s carbon emissions reduction targets still to be legislated and the creation of Net Zero Commission to track the state’s progress against targets yet to be funded.

The NSW Government previously announced $1.8 billion in funding for the state’s energy transition, including an election commitment to establish an Energy Security Corporation, a state-owned body that will accelerate investment in renewable energy assets. The Corporation will focus on storage projects as well as investments to improve reliability on electricity network, such as community batteries that reduce reliance on the grid.

There is also an additional $804 million for the Transmission Acceleration Facility (administered by EnergyCo) to connect the state’s Renewable Energy Zones (REZ) to the grid sooner and bring forward the benefit schemes for communities, as well as progressing other planned REZs such as the Hunter Transmission Project. Importantly, the NSW Government has also committed to addressing housing, transport, skills and workforce and supply constraints in Renewable Energy Zones.

These funding announcements follow the NSW Government’s response to the Electricity Supply and Reliability Check Up report, which includes a renewed commitment to the Electricity Infrastructure Roadmap, an Energy Security Target Monitor to ensure ongoing reliability of coal-fired power stations (including potentially keeping Eraring Power Station open beyond 2025) and streamlining renewables approvals in the planning system.

The NSW Government also announced over the weekend that they are removing the $3,000 rebate for buyers of new electric vehicles, redirecting $260 million into electric vehicle infrastructure, including additional charging stations in apartment blocks and commuter car parks for motorists who do not have access to home charging. Transitional arrangements will ensure anyone who has bought or placed a deposit on an eligible EV, and are awaiting delivery of the vehicle, will still be eligible, regardless of whether the vehicle has been delivered by January.

From 1 January 2024, the stamp duty exemption for electric vehicles under $78,000 will also no longer be available, ahead of the introduction of a road tax on electric vehicles commencing in 2027. The road user charge, which is anticipated to be around 2.5 cents per kilometer may be implemented earlier if EVs account for 30 per cent of new light vehicle registrations.

Prominent in this Budget are a range of cost-of-living relief measures, including the Energy Bill Relief Payment announced in July. The Energy Bill Relief payments are being delivered by the NSW Government under a partnership with the Commonwealth. It includes $485 million pledged by the NSW Government and $481 million by the Commonwealth Government to provide targeted, temporary energy bill relief in the FY 2023-2024.

The NSW Government will also increase a range of electricity rebates available to eligible households that will be available from 1 July 2024, including an increase in the Low Income Household Rebate and Medical Energy Rebate from $285 to $350 and an increase in the Family Energy Rebate from $180 to $250.

The Property Council welcomes the NSW Government’s focus on decarbonising the grid through well-targeted government intervention. While there is a wave of private capital available to invest in clean energy projects across Australia, investment in large-scale grid-firming technologies, like pumped hydro, has proved challenging for the private sector.

These high capital, low yield projects often do not attract private financing because their return on investment is too long realised. Bridging this market gap through public financing makes sense and will go some way to improving reliability as we transition to a renewable-powered grid.